Over 50s travel insurance is the big opportunity.

Growing old and developing long term medical conditions will inevitably have an impact on your life, but it doesn’t seem to affect people’s intent to travel abroad. Our over 50s market are richer, fitter, healthier and feel younger than ever before with many releasing equity from homes in order to travel more adventurously. Whilst the importance of millennial travel has been widely documented, according to ONS data it’s the 50-64s who are the biggest hitters in terms of spending on holidays abroad, with the 65-74s not far behind. An average of £7.90 is spent per week on holidays abroad by the 50-64s, compared to £4.70 by 30-49s. According to ABTA, the over 50s hold 76% of the nation’s wealth and 40% of them spend more than £3,000 a year on holidays. Whilst millennials might be more vocal around their travel experiences (check out travel industry trends 2019), the over 50s are the unsung spenders of the travel category and yet there are so few suitable over 50s travel insurance options available.

Over 50s travel insurance – what’s already out there?

But with older travellers and those with medical conditions finding it more challenging and expensive to get travel insurance, it’s a large and growing market with untapped potential. We’ve seen Saga consolidate its holidays and travel insurance under one brand, whilst Berkshire Hathaway recently launched Wavecare, travel insurance designed for cruisers. Despite the entry of new players such as the Post Office and Co-op alongside more established specialists like Staysure (2004) and AllClear (2000); brand awareness of these services is low, and existing players are failing to engage the 7m British holidaymakers who travel without the right insurance because of undisclosed medical conditions.

So what should brands be doing to make an impact when launching in this sector?

Long term brand investment is key.

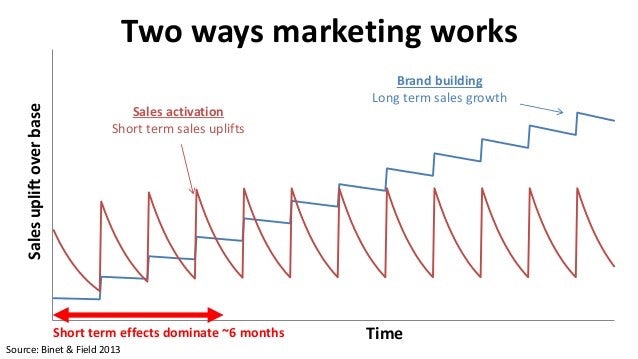

Recent research by Les Binet and Peter Field from the IPA effectiveness papers has shown that many insurance companies have decreased investment to brand building activity in favour of short term sales activations such as promotions and deals. However, the study showed that for lower interest categories like insurance, long term brand-building effects that tap into System 1 thinking (the instinctive, emotional and intuition-driven thinking described by Kahneman’s Thinking, Fast and Slow) are harder to achieve, so need to receive a greater proportion of the marketing budget – up to 80%. We’ve seen well-known brands like the Post Office and Co-op entering the market, but they’re not known for specialist insurance, so there’s an opportunity to own the over 50s travel insurance space.

Staysure have recently launched a brand campaign covering the ‘tailor-made’ aspects of their offering, but there’s much work to be done for most players in the specialist travel insurance market. The specialist players are largely unknown, whilst well-known brands offering travel insurance like the Post Office, are not widely recognised as specialist insurers, so there’s an opportunity to own the space.

Avoid over 50s stereotypes.

The over 50s are joining dating apps, travelling the world and are fitter and richer than ever before. Stereotypes of older people seen in stock footage are no longer going to cut the mustard with an increasingly discerning and ‘youthful’ audience. This means thinking beyond featuring grey haired talent in the advertising and demonstrating empathy with the audience. This audience tore up the rule book in their youth through gender politics and the pill, so their relationship with ageing is a very different one.

Those with medical conditions don’t suffer from their conditions, they live with them.

Those that have ongoing conditions like arthritis or diabetes are often very good at managing their conditions and have every intention of travelling. Far from being put off travel, they want to get the most out of life and don’t want their medical situation to define their opportunities. The rise of multigenerational holidays has seen New Zealand based travel insurance comparison site covering grandchildren for free and presents their offering in a way that appeals to seniors’ sense of fun. However, because of low awareness around the over 50s travel insurance products available, many are lacking the correct cover altogether, putting their health and holidays at risk. The challenge is to engage the older audience of those with medical conditions while avoiding cliches around what it means to have one.

Image Credits

- ‘Effectiveness in Context’, IPA Binet and Field, 2013

- Shutterstock (for images)

- Office for National Statistics

- https://www.kingsfund.org.uk/projects/time-think-differently/trends-disease-and-disability-long-term-conditions-multi-morbidity

- https://www.telegraph.co.uk/property/news/over-50s-hold-three-quarters-uk-housing-wealth/

- https://www.savills.co.uk/insight-and-opinion/savills-news/239639-0/over-50s-hold-75--of-housing-wealth--a-total-of-%C2%A32.8-trillion-(%C2%A32-800-000-000)

- https://www.telegraph.co.uk/financial-services/retirement-solutions/equity-release-service/equity-release-customers-rises-second-quarter-2018/

By Constance Meath Baker

Strategic Planner